If you are owning a business when you apply for a merchant account there are several categories based on a few factors. Depending on the risk level your business will fall either under low-risk, mid-risk or high risk category. There are various factors a processor shall categorize your business under high risk. And this depends on either business’s industry, clientele or merchant’s business practices.

High risk businesses find it difficult to find a merchant account due to the risk factor. The main reason behind this is the high number of chargebacks. This happens when a customer makes payment through his card for a purchase and then disputes it with the bank directly skipping the payment processor. The bank will analyze the transaction and then reverse the charge if it is a valid dispute. There are few other reasons you might be considered high risk if you are terminated merchant, if you are a new business with less processing history, if you have a multi-currency business also if you have a bad credit history.

Is it difficult to get a high risk merchant account?

Many payment processors work with low-risk merchants just to be on the safer side. Now we understand that high-risk merchants will be left with few potential high risk account providers. Virtually it is impossible for ecommerce merchants to operate without accepting debit and credit cards. If you are into any form of business you understand how difficult it is, especially if you’re a high risk company. It is almost impossible to get an account with traditional banks. Even if you do you will be asked to adhere to some compliance requirements.

Each processor will categorize businesses based on their own set of guidelines to see if they fall under high risk or low risk category.

This is when merchants need to find a high risk merchant account provider. High risk merchant account is designed specially keeping in mind the need of high risk businesses. Lots of providers offer tailor made solutions which suits your business requirements. However, there will be various fees that you might have to pay like application fee, monthly fee etc.

What to expect from a high risk account:

There are several providers in the market with various terms and conditions and getting a high risk merchant account always comes with a price.

- Fees and terms:

You might be lucky to get a quick approval. However high risk merchant account might demand a high fee than traditional account where you just need to may minimal fee. The contract restrictions as well will be quite strict.

- Rolling reserve:

Rolling reserve is like a security deposit taken from the merchants by the acquiring bank which acts as a shield in case if there is a chargeback. There are 2 basic rolling reserve types. The first one is an Up-front reserve wherein the merchant gives the processor permission to hold all funds until the desired reserve balance is fulfilled. The second one is wherein the processors hold a certain percentage of daily revenue and then release it once there is enough funds available in the account.

Types of business categorized high risk:

There are several business that is categorized under high risk business. For example, Travel industry that’s because there will be various reasons that might cause cancellations. There are lots of chances that customer apply for a refund and also file for a chargeback. Here is a list of businesses that fall under high risk category.

- Adult merchants(adult bookstores, online adult membership or matchmaker)

- Antiques

- Banned / illegal goods & services

- Casinos

- Gambling

- Gaming

- Cigarettes

- E-cigaretts

- CBD

- Vape

- Dating

- Debt collection services

- Fantasy sports websites

- Health and wellness products

- Horoscopes, astrology or psychic services, fortune-tellers

- Nutraceutical

- Forex

How iPayTotal can help and how iPayTotal is revolutionizing the industry:

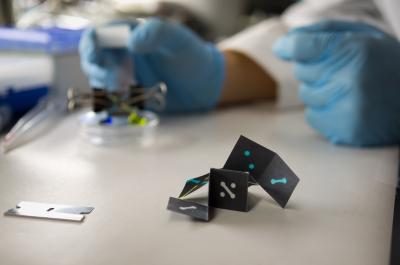

iPayTotal is a UK based company and we focus mainly on high risk industries such as CBD, online gaming, online dating, Forex etc. We believe in making it simple for merchants. We understand the challenges faced by high risk merchants and worked on this over the years to build a system that is suitable for high risk ecommerce merchants.

- Significantly expanded acquiring banks: We have several acquiring banks domestic, international and offshore. Each and every acquiring bank is unique. We understand the requirement of the merchant and try to place them to the acquiring bank that is best suitable.

- Online payment gateway: We have a payment gateway which is an independent platform which facilitates safe and secure payment processing. We have a PCI DSS Level 1 Certified cloud payment platform. This platform allows customers to pay merchants securely for goods and services online, mobile etc.

- We have a built-in fraud prevention: We have worked with thousands of merchants and understood various fraudulent activities. We understand how difficult it is to cope with loss due to fraudulent activities. So we have built a system which filters various fraudulent activities wherein the merchant needs to place restrictions to keep fraudulent customers away. Our dashboard is simple, user-friendly which shows accurate, real time data of your transactions. It is accessible anywhere, anytime that makes your life simple.

If you are looking for a high risk merchant account. Call iPayTotal now.

Topics #high risk industry #iPayTotal